Introducing lease management

Most companies manage an unprecedented number of leases in their day-to-day business. As a result, the importance of having sound infrastructure and lease management processes in place has become crucial to success. Whether your company is leasing offices or other forms of property, it's essential to understand the total cost of lease administration and where time-consuming processes and systems may be stalling your company's growth.

In this complete guide to property lease management, we break down the common challenges companies face and present multiple solutions and strategies to help you optimize your lease administration and better manage your properties. Learn what to look for in lease management software and access several resources to help you remain compliant with accounting standards ASC 842, IFRS 16, and GASB 87.

Who should read this guide?

This guide is ideal for anyone interested in property lease management, lease administration strategies and maintaining compliance with accounting standards ASC 842, IFRS 16, and GASB 87.

What exactly is lease management?

Lease management is a broad topic that focuses on simplifying the management of multiple leases and subleases. As a best practice, companies use lease administration software to help them streamline complex tasks such as managing renewals, generating delinquency and vacancy reports.

Property lease management is also concerned with growth strategies, future forecasting, and helping companies scale, while still maintaining compliance with lease accounting standards (ASC 842, IFRS 16, and GASB 87).

Optimizing your strategy

With leases subject to more scrutiny than ever before, it's essential that companies fully understand the need to improve their lease management strategies constantly. It's common to make the mistake of treating lease management as a nuts-and-bolts operation. Learn new ways to streamline your lease administration and accelerate your growth in this optimizing your property lease management strategy infographic.

7 benefits of optimizing your property lease management strategy

- Understand and improve market performance

- Save administrative costs, both time and money

- Tackle revenue loss factors and risks as they arise.

- Improve your future growth forecasting.

- Achieve global accounting compliance.

- Gain a higher return on your investments with more actionable insights.

- More ROI opportunities with better reporting

-

Read more

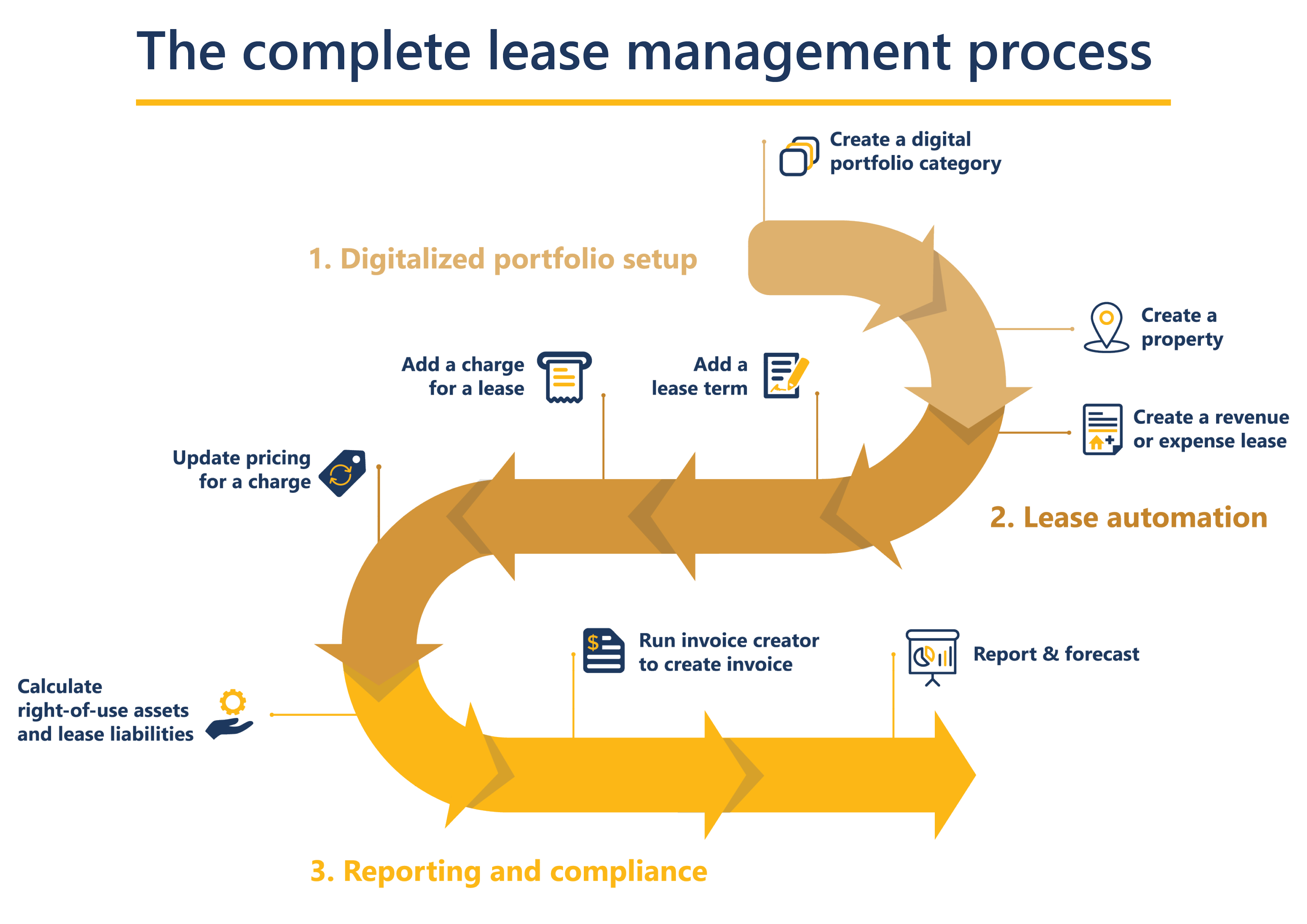

Better manage your lease management strategy

Effective lease management strategies result from the successful implementation of reliable processes and automation that allow your company to optimize each stage of the lease lifecycle. Companies need to introduce automation of time-consuming and labour-intensive processes at crucial stages of each lease. The following graphic maps the entire lease management process from start to finish. As you can see, there’s plenty of room for automation to keep information flowing from one stage to the next.

How to reduce risks in your property lease management strategy

Investing in appropriate property lease management software to handle your lease administration processes is one of the simplest ways to reduce risks. There are several ways the right software can lighten the administrative load and streamline your processes to ensure you remain compliant with the ability to scale lease operations as you grow.

4 ways lease administration software reduces risks

- Minimizes the admin burden and gives full visibility of your company’s financial health.

- Implements lease changes easily in uncertain times.

- Reduces mistakes and highlights critical issues in your system with automation.

- Enables compliance with accounting standards ASC 842, IFRS 16, and GASB 87.

Compliance with accounting standards ASC 842, IFRS 16, and GASB 87

When it comes to effective lease administration one of the biggest challenges is proving your company meets the requirements of accounting standards like ASC 842, IFRS 16, and GASB 87.

In the resources in this section, we outline the challenges your company is likely to face and best practice for enabling ongoing compliance as you grow.

Additional resources for lease accounting administration and compliance

Operating versus finance leases

One of the biggest questions around complying with the new leasing standards is around the definition of operating and finance leases. In this short guide, we outline the compliance standards for both as well as offer a table which covers the main differentiators between the two.

What is an operating lease?

An operating lease is a type of lease in which the lessor allows the lessee to use an asset for a short period in place of periodical payments but does not transfer the asset's ownership rights.

What is a finance lease?

A finance lease (sometimes referred to as a capital lease) is a type of lease in which a company has the accounting characteristics of owning the asset for the lease duration. The lessee has operating control over the asset and shares some of the economic risks and returns from the change in the underlying asset valuation.

Table of differences between operating and finance leases

| Difference | Finance lease | Operating lease |

|---|---|---|

| Term of the contract | Typically, a long-term contract | Typically, a short-term contract |

| Ownership | Transferred to the lessee | Remains with the lessor |

| Type of contract | Loan agreement/contract | Rental agreement/contract |

| Burden of maintenance | Lessee must maintain the asset | Lessor must maintain the asset |

| Risk of obsolescence | Lessee | Lessor |

| Cancellation | Often difficult or impossible, some exceptions exist | Possible throughout the contract |

| Tax advantage | Expenses such as depreciation and financing are tax-deductible for the lessee | Rent deduction allowed for the lessee |

| Purchasing | Option to purchase the asset | No option to purchase the asset |

How to choose the best lease accounting software

Property lease management software varies significantly in both the quality and the functionality of its features. If you’re investing in software to help manage property, plant or equipment leases, then you need to be aware of the features required to manage the complexity of lease portfolios.

Resources to help you choose the right property lease management software

Property Lease Management

Property, plant, and equipment lease management software with all the flexibility needed to suit the demands of your industry.

Built directly into Microsoft Dynamics, this solution gives you a comprehensive set of tools to streamline and automate lease administration, while allowing you to work within a familiar interface.

Portal login

Portal login